Capacity growth and its potential impact on energy prices and asset values

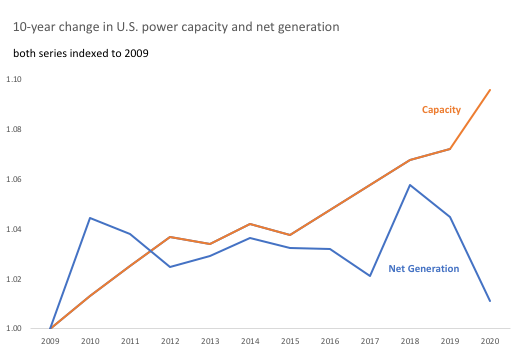

We have written extensively on the impact of rising power generation capacity on both short-and longterm

power prices. U.S. capacity, net of retirements, has grown by nearly 1% annually on average since

2010 while demand has barely grown at all (less than 0.1% on average). This imbalance has increased

excess capacity, or reserve margin, for the country as a whole and contributed to a fairly steady decline

in benchmark wholesale prices over the past several years.

Wholesale power prices have rebounded somewhat in the past year and got an additional boost in the

important ERCOT market from the recent weather-related demand spike in the U.S. Midcontinent.

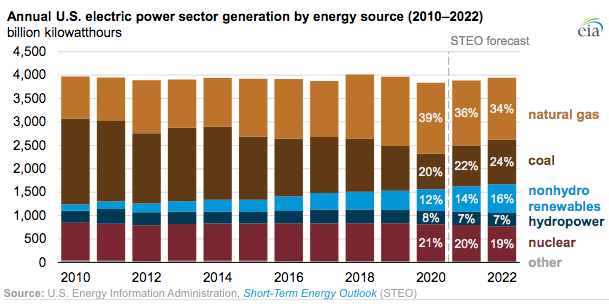

Some analysts have viewed this as the beginning of a long-term rebound in the market. But many of

those same analysts also expect U.S. renewable generation capacity to maintain its recent growth rate

of 10-20 GW per year for the foreseeable future, after some setbacks in 2020 due to Covid-19-related

sourcing issues. Such forecasts are based on a continuation of the same factors that have contributed to

the recent growth: continued low interest rates and investor enthusiasm for yield; declining cost curves;

and attraction to new – especially green – technology.

This is a nearly unanimous growth story, driven by a widespread belief that demand for renewable

power will support a steep supply trajectory as individuals, companies, and, especially, governments,

seek to increase the share of these sources in their consumption. Mandates in several states, for

example, require that utilities purchase increasing percentages of zero-carbon power to serve their load.

Most companies that consume significant amounts of electricity have developed a similar posture on

the portion of their demand that should come from renewable sources. Households, though still small

by comparison, are following suit.

There is a lot of competition to provide the new generation capacity. Most utilities, independent power

producers, and developers have access to the deep well of cheap capital and have the expertise and

engineering capability to develop projects. These companies are eyeing the rosy demand assumptions

and bidding for projects accordingly. Industry analysts and academics, especially those in favor of a low-

carbon future, are cheering on the rapid deployment.

Is there any downside to such development?

It is important to consider that consumers are unlikely to grow their power demand in the next few

years. Rather, they are likely to continue what they have been doing: shifting from one source to

another, resulting in the retirement of expensive legacy thermal power generation plants. But those

plants aren’t closing fast enough to offset the pace of new generation and this is why reserve margins

have increased in most regions of the U.S. They are likely to continue to do so.

Yet analysts forecasting rapid growth in renewable capacity rarely, if ever, consider the implications of

aggregate capacity and its potential impact on wholesale power prices when they plot their expected

growth rates. Their assumptions are most often based on steady or even higher energy prices, which

may seem more likely today given the recent bottoming in 2020. But this would be inconsistent with

everything we’ve learned from the past. Growing supply and flat demand are more likely to continue to

push prices lower, not higher.

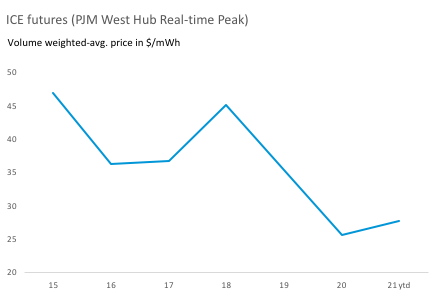

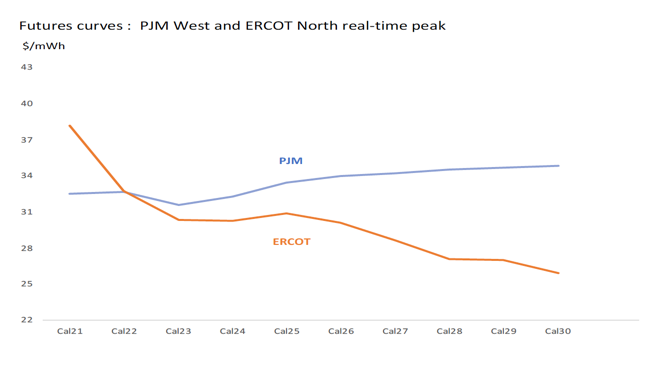

This impact has two main components. In spot markets, there is ample evidence of the downward

impact on prices from greater capacity. This is most clearly seen in the markets where renewable

capacity has been added most significantly: in ERCOT and – depending on the time of day – in California

ISO. Prior to this month’s weather event, ERCOT prices for even peak summer months were under

steady downward pressure. But this pricing pressure is also evident in other regions, principally in the

competitive PJM market where capacity growth is picking up pace.

In forward markets, a similar dynamic (more sellers than buyers) has been playing out, and these

markets have more direct implications for the availability of capital to fund the next generation of

renewable assets. The vast majority of the new capacity is project-financed and needs to be hedged

several years forward in order to lock in their economics. There have not been enough long-term buyers

to offset the generators’ selling interest, so long-term prices also followed a multi-year downward

trajectory – until 2020. Like spot prices, the decline in long-term power prices also found a bottom last

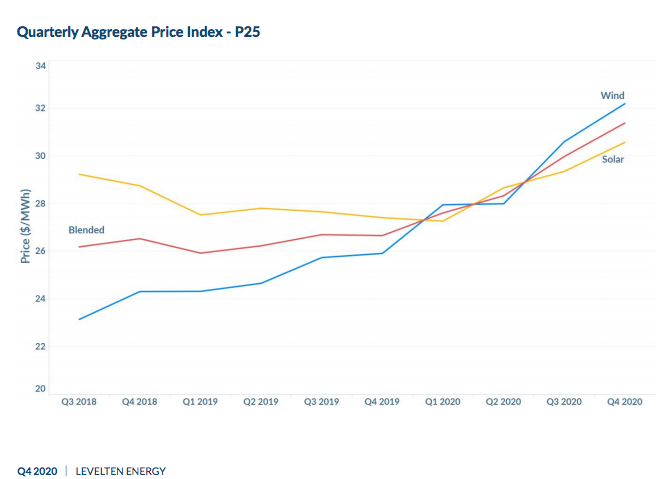

year that some observers have taken as a sign of a looming rebound. The chart below shows quarterly

PPA offer levels from LevelTen Energy’s latest index update.

As with spot prices, long-term power prices should also reflect supply and demand fundamentals. As

supply continues to grow via expanding capacity, there is a real likelihood that the recent rebound of

prices across the forward curve to revert to the longer-term trend (lower). This is the main risk to

today’s forecasts of renewable power’s steady growth, as a decline in long-term wholesale prices may

no longer support all of the expected capacity. How that inflection may come about is anyone’s guess,

and in large measure depends on the pace of retirement among legacy thermal assets. Nevertheless,

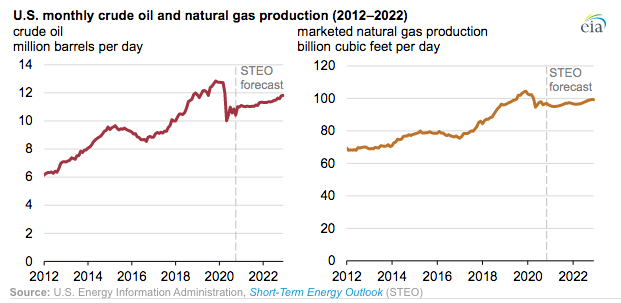

other energy markets offer some perspective and next we discuss some aspects of oil and gas

production, development, and the role of commodity markets in directing the industry’s activity.

Utility and IPP investors vs. E&P and other energy investors

Investors and, especially, analysts tend to stay in their lanes. Those that invest in or study oil and gas

companies rarely have any corresponding interest in utilities, independent power producers, or

renewable developers. Yet oil and gas exploration and production (E&P) shares some similarity to

power generation: both are capital-intensive industries with significant investment requirements that

provide energy to wholesale markets (in varying degrees). Arguably, as oil and gas production evolves

away from a riskier past and toward a more manufacturing-based model (based on higher-probability

hydraulic fracturing technology) its resemblance to power generation is even greater. Still, investment

professionals and their support teams tend to view these industries very differently.

Utility investors focus primarily on the regulated side of the business because it is typically the most

significant source of revenue, as well as the most stable. Those that focus more on unregulated

businesses – primarily in generation (IPPs) – tend to study load growth as well as transmission

constraints on generation (basis risk) because those are the main drivers of wholesale market revenue in

specific regions where those companies own assets. Benchmark prices for electricity (energy), capacity,

and ancillary services are less important to most investors and analysts, perhaps because they are so

difficult to forecast. One can utilize them to explain the past, but it’s much harder to leverage forward

power markets to form a composite view of the future.

By contrast, market prices for oil and gas (spot and futures) are front and center in the minds of anyone

with a financial interest in E&P companies. In this industry, revenue is largely determined by the

mathematical product of price and volume; forward markets dictate the price very clearly. E&P

companies’ management teams consider forward commodity prices in their growth plans and may seek

to lock in a portion of their exposure in order to service financing or simply to constrain any decline in

revenue attributable to lower commodity prices.

Oil and gas investors consider hedge ratios and effectiveness across various companies, and often have

their own point of view on commodity prices in their decisions on allocating risk capital in equity and

debt markets. They understand the degree to which individual producers and processors are geared to

forward prices based on companies’ stated hedge ratios. Such knowledge may be less important for

investors in integrated oil companies, or for those in related industries like midstream, refining, or

petrochemicals whose revenues may be less directly determined by outright prices of oil and gas.

By contrast, for utility and IPP investors such benchmark prices – the power equivalent of WTI crude oil

or Henry Hub natural gas – are of far less interest. This is understandable because for most of recent

memory the market’s composition has been very stable. Capacity changes were gradual, demand

changes were small, and power prices were relatively steady. Even as renewable capacity started to

take off in the early 2000s their tiny base limited their relevance to the overall market.

But this changed over the past several years as capacity changes have picked up pace and the renewable

asset base is no longer a rounding error. It now has significant market share and its impact on overall

prices is becoming more significant. Still, investor circles still seem to be focused on traditional ways of

looking at the market, considering relative performance of companies or perhaps geographic regions.

The impact of growing supply on the commodity price isn’t really registering in the discussion. But it

should. It will have a growing impact on economics of development everywhere – much like it already

does in the other energy markets.

Capital markets embraced E&P industry’s rampant CapEx spending, but not anymore

Notwithstanding the differences among investors noted above, those backing U.S. oil and gas industry’s

renaissance over the past decade or so shared a common aspiration with those focused on new power

generation capacity: owning companies that invest huge sums of money in new technology to extract

resources increasingly efficiently. All such investors view their quarry as technology-heavy businesses

with significant growth potential. Indeed, E&P companies were regarded as growth stocks, perhaps

given the degree to which their production methods took advantage of relatively novel fracking

technology. This was considered different from other sectors of energy – especially refining and

marketing where technological advancement was more incremental – and more akin to the growth

mode of renewable power.

Given the transparent linkage between E&P equity valuations and commodity prices, investors were

willing to continue funding the industry’s growth plans as long as commodity prices held up. In the most

recent cycle, cheap equity and debt capital fueled significant growth in production capacity, all of which

was utilized (sold into the market). Commodity markets held up reasonably well for a while, especially

for oil, as global growth continued through the late 2010s. Natural gas prices began their slow descent

years earlier but were less of a focus for most production companies.

All commodity prices eventually crashed in early 2020 due to the pandemic. Oil fell particularly sharply,

into briefly negative territory, as it also suffered from a short-lived battle for market share among major

international producers. In this episode, and in previous ones over the past few decades, investors

realized that the technology and growth stories suddenly don’t matter so much; it’s still a commodity

business. Specifically, E&P investors were reminded that capacity additions matter to commodity

markets. Those same companies that had been technology and growth stories became workout stories

as bankruptcies mounted.

Investor attitudes have since shifted away from unbridled growth toward a greater focus on discipline

(slower growth). They are no longer willing to fund rapid expansion and are expressing this view via

their reluctance to invest significantly at lower valuations. The cost of equity capital has gone up. E&P

budgets have subsequently been slashed, in many cases by 50% or more. The impact on expected

forward production has since been factored into commodity markets, allowing those prices to rise (both

oil and gas) and the cycle continues. Equity values are rebounding.

Supply growth exceeded demand growth over the long term and, ultimately, led to commodity and

equity market corrections from which pain is still being inflicted on investors. That pain is driving new

thinking on the benefits and costs of aggregate growth in supply. It has led to a severe rationalization

among producers and developers and a higher cost of capital.

This shift didn’t happen overnight and it isn’t the first time it has occurred. But, in general, oil and gas

investors understand the implications of aggregate supply and demand on commodity markets and the

direct impacts of those markets on those with exposure to them. And they are telling E&P companies

that they are unwilling to finance continued rapid growth in supply unless the industry can demonstrate

that the returns will justify it. At today’s commodity prices – both spot and futures prices – those

returns are not yet evident.

Can renewable developers face similar situation?

Equity and debt markets for utilities and independent power producers are flashing mostly green today,

especially those with the greatest investment in renewable power. The threat to their livelihood from a

developing surplus of capacity – and corresponding decline in commodity prices – seems remote based

on current valuations. One good reason for such a lack of concern: most such companies’ projects are

hedged well for the next several years, either via fixed-price physical offtake agreements or financially-

settled power purchase agreements.

Indeed, to date there hasn’t yet been a broad bust cycle among independent power producers. There

have been failures, including some very significant ones. But those have been mostly among companies

that owned thermal generation, typically in localized conditions where pricing was especially

competitive and leverage ultimately proved excessive relative to those market conditions. Failures

among companies focused exclusively on renewables were attributable to particular circumstances,

especially in retail (distributed) markets, and not to weakness in the wholesale energy market.

A broader selloff – like that which hit the E&P sector last year – has yet to take place. But there is no

reason that it couldn’t happen in the future, especially if the guardrails holding up companies’ long-term

revenues become less supportive. This is clearly an unpopular view, and maybe an unlikely one. But it

needs to be addressed by those whose expectations are for steady supply growth without any

downside. There may be solutions to combat lower power prices (e.g. a federal carbon tax, which we

address later) but, in the absence of such a crutch, market forces will dictate the value of all assets.

A brief distinction in capital structures

Across energy infrastructure it should be noted that financing varies significantly according to the assets

that are being developed. Oil and gas exploration and production, as well as downstream processing

and refining, are almost entirely financed on the balance sheets of the operating companies making

those investments. Project finance is rarely, if ever, utilized – even for the least-well-capitalized

companies. This is perhaps due to the significant risk involved in development, especially upstream,

where dry holes have been a common feature and must be diversified across geographic and geologic

regions. In foreign operations, political or country risk can also be significant and best handled via

portfolio diversification.

Large, diversified utilities may choose to finance development on their balance sheets, but for different

reasons. The projects themselves may be far less risky than oil and gas development, but since utilities

can apply to regulators for guarantees on their investment they may choose to go this route. Their

capital structures are very different from independent developers and tend to have considerably higher

credit ratings that enable them to finance such projects at comparatively attractive interest rates. Off-

balance sheet financing might make sense for some projects but may be comparatively expensive given

lack of recourse to the company’s full faith and credit.

An increasing share of power development has taken place away from regulated utilities, by

independent power producers that sell their output into the open market. These companies tend to

finance new construction via project finance channels. This choice is based on two things: First, unlike

the more diversified utilities, development companies do not have significant balance sheets from which

to fund and finance their activity. Second, there is a willingness of investors to expose themselves to a

single asset or group of closely-associated assets on the expectation that once the asset is built it can be

counted on to produce the desired output in a highly-ratable fashion. There are no dry holes in power

generation as it’s a proven manufacturing process and technology tends to be well established.

Investors will finance individual projects with significant leverage as long as certain risk mitigants are

incorporated into the capital structure. In order to guarantee a portion of their revenues, the

developers need to find long-term buyers that will commit to fixed pricing for several years into the

future. This challenge has been somewhat handily met in recent years by a number of commercial and

industrial buyers who have committed to purchasing a significant portion of their forward power needs

from renewable generators and, hence, at fixed prices. Such buyers must themselves be credit-worthy.

Other mitigants include financial guarantees around operating performance, without which capital costs

for power infrastructure investments would be prohibitively high for independent developers.

We pointed out in a previous review of financial conditions for the industry (see Alpha Power Advisers’

Power Risk, Oct. ’20) that public equity and debt markets have been increasingly favorable to renewable

developers in recent years. We are not at all alone in this assessment. Financial conditions are far

easier for these companies than for the other energy producers discussed above.

How have investors done so far?

So far, these investments have largely panned out. Large-scale solar and wind developers and operators

have paid back investors with relatively few casualties – certainly by comparison with oil and gas

developers and operators. Indeed, the only significant casualties of this wave of development have

been the high-cost legacy thermal generators displaced by all of the new renewable capacity.

Power generators’ active use of hedging has no doubt been a part of the success story. And given the

long tenor of those hedges, most of the generation capacity that has been developed over the past 10

years is still hedged under the original PPAs and VPPAs, mostly at considerably higher prices than what is

currently available in the market.

PPA prices and developers’ assumptions about power prices beyond the tenor of PPAs are only

interesting to investors insofar as they provide a guardrail on returns for a defined holding period. Such

a holding period may well be shorter in tenor than the PPA, so the investor expects to exit their position

before the plant enters the so-called merchant stage of its life.

But even in that situation, there is exposure to lower power prices as any bidder for the asset in the

future would also care about exposure during the merchant stage of the asset’s life. They, too might

wish to lock in several years’ worth of expected revenue in the forward market at that time, but would

be subject to market pricing that hasn’t yet been determined.

Aside from expected revenues, investors might also be attracted to management’s ability to run the

assets efficiently and thus reduce operating and maintenance costs. But judging from equity analyst

reports, the factor that most attracts investors in renewable resources is the growth prospect. Most

developers and operating companies have a significant pipeline of projects that imply growth in revenue

against stable costs and thus higher net returns through time. A key to growth in revenue is stable

commodity prices.

Financial comparisons across these industries using publicly available data aren’t easy to make. Unlike

oil and gas, there are few public companies whose focus is purely on power generation development.

Most such companies are owned by private equity. There are, of course, renewable developers that are

publicly traded (e.g. NextEra, RWE) but those companies mostly have significant regulated utility

ownership as well, which greatly obscures the financial returns of their unregulated businesses.

From what we can gather from public and private data sources, equity and debt financing costs are as

low as they have ever been. The only financial constraint on renewable development has been the

expiration of federal tax incentives. Among the most common explanations for the benign financial

conditions: consistently declining cost of development, especially equipment, and ability to secure longterm

fixed-price contracts such as PPAs.

The first explanation has merit, as there is little reason to expect the trend in cost reduction to reverse

course. Technological advancement continues to benefit everyone involved throughout the value chain.

And as generation – and now storage – technology scales up, the impact on unit costs continues to exert

downward pressure. Equipment is traded internationally and may be subject to tariff and non-tariff

barriers, but in the long run those impediments become less important to overall efficiency gains.

As for the second explanation – ability to secure long-term fixed pricing – the outlook is less benign.

Some observers see increasing demand from nontraditional buyers coming into the market, if only

driven by growing adherence to ESG concerns. But there’s also evidence to the contrary: it isn’t as easy

to secure long-term fixed-price offtake agreements at prices that prevailed over the past few years.

Buyers, especially those that have been active in the long-term power market, understand the multi-

year pricing trend and have taken a more relaxed posture in their bidding. Until the recent rebound in

PPA pricing, developers had to lean harder on expected cost declines and longer asset lives to meet their

financial objectives.

Aside from the impact of Covid-19, the pace of development has held up. But there is evidence that

perhaps not everyone is winning today, or at least some are winning less. PPA prices are clearing at

levels that some developers consider marginal to the economics of development. Moreover, PPA

expirations are getting shorter, exposing developers to greater degrees of merchant pricing risk after

they expire. Whereas some may have been willing to commit to 20 years or more in past offtake

agreements, today they may only be willing to commit to 10 years.

For an asset with a life expectancy of 25 years, this shift is significant. It means that rather than having a

fixed price for nearly the full life of the asset there is a fixed price for less than half of its life – beyond

which financial performance is subject to then-market prices. Owners must make assumptions about

what prevailing prices will be once those agreements run their course. And those assumptions can

matter greatly to the asset’s value today – especially if existing fixed-price agreements don’t extend

more than 10 years into the future. If the assumed price is high it will improve the attractiveness of the

investment; if it is low it may kill it.

Moreover, projects that have been developed over the past several years may be coming toward the

end of their fixed-price agreements, adding to the roster of assets that need to sell forward power in

order to provide some certainty around their financial condition for the next phase of their lives. This

greater exposure to merchant pricing means that developers are taking on more financial risk than they

had previously in order to maintain deal flow. Financial conditions are still favorable to the industry but

projects are not without risk. How they handle it matters.

Valuing prices beyond PPA tenor

PPA valuations are frustratingly complicated, so it isn’t easy to assign a reasonable price forecast to such

a contract beyond its current expiration. But doing so credibly is essential for evaluating any generation

(perhaps with storage) asset and for making decisions today about whether to proceed with such a

development, especially if the fixed-price agreement only covers half the asset’s expected life.

Part of the difficulty of valuation stems from the proliferation of revenue components for any given

asset. The energy price is only one such component, albeit a very important one. In addition, there are

potential capacity payments, ancillary services and, of course, environmental credits. Each of these

varies by region and by specifics of the asset. For simplicity, we only focus on the energy component.

The key challenge in valuing the energy component beyond the tenor of a PPA is in formulating the

shape of the entire forward curve. Given the opacity around long-term power prices, especially in the

locations where many of these projects will operate, forecasting the level of forward prices is

challenging. It could well be described as more artistic than scientific. Arguably, developers and their

financiers should simply extend the price at which their contracted buyers are willing to bid. For

example, if a 10-year PPA is fixed at $30/mWh then one could assume that the period beyond 10 years

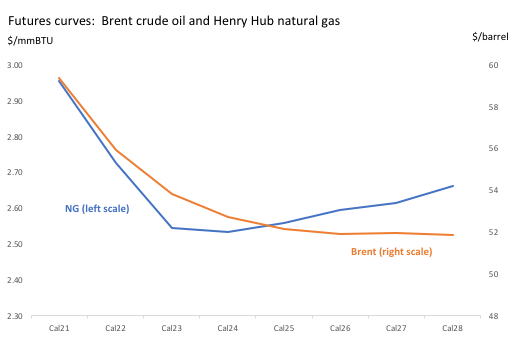

has the same price. A slightly more scientific approach would be to utilize the slope of the forward

curve, especially at the back end (e.g. years 5 through 10) and extend that slope into the future beyond

10 years, perhaps with less slope. Such an asymptotic shape would be consistent with the shapes of

other estimated energy forward curves in tenors where there aren’t sufficiently frequent actual trades

(see crude oil and natural gas curves below).

A step change in price assumptions from years 1-10 to years 10-20 would not be credible in any of these

commodity markets though it could be deemed conservative if the longer-dated price were substantially

lower than shorter-term prices. Rather, as one might expect, developers and financiers of power assets

tend to do the opposite: assume, or forecast, that the longer-dated prices are substantially higher than

what can be transacted for the first 10 or so years of the asset’s life. This may not seem very credible,

but in the absence of any evidence to the contrary it might be the only way to make a project’s

economics work. And if it’s credible enough for lenders to extend credit the financing can be secured.

Are there other potential sources of support?

Looking forward, there are some factors supporting growth in demand for renewables that will provide

support to offset any resumption in the long-term price decline. One of the biggest such factors is from

the regulated market where many utilities need to contract with renewable sources in order to meet

state mandates for clean energy. Those states have implemented such mandates with increasing

renewable market shares several years (or decades) into the future. But these state programs alone

cannot absorb all of the capacity that many expect to come online during this period.

There is also the possible imposition of a federal carbon tax that would raise the cost of thermal

generation, making those sources less competitive and, by extension, accelerating their retirement from

the generation stack. The net result would be a narrower reserve margin overall, potentially justifying

higher prices. But there is no actual plan for such a tax, let alone when it might be implemented.

Another potential driver of higher prices: a resumption of demand growth after a decade or so of flat

demand. This could come about from faster economic growth, but more likely it would require new

sources of demand, including electric vehicles and, eventually, a transition toward electric heating of

commercial and residential structures (at the expense of natural gas). There will certainly be greater

demand from the transportation sector in the future, but the magnitude is still very unclear as adoption

rates remain in the single digits and may remain so for a while – especially in trucking. It is possible that

demand growth could accelerate to meet capacity growth by the end of the 2020s, but such a balance

requires a credible forecast of capacity growth in that time frame, which we don’t have. What we do

know is that today’s investment climate favors steady capacity growth over the next few years when

demand growth is likely still to be quite limited.

Lastly, commodity markets tend to revert to mean levels, unlike financial assets such as equities (which

can keep rising indefinitely). There is perhaps a justification for an assumption that the recent decline in

power prices can only be followed by one of rising prices, toward an average long-term price. Oil and

gas markets can dislocate, sometimes massively, but they tend to revert toward long-term means and

their long-dated price curves often tend toward those levels. Power prices may do the same, perhaps

after a longer period of deviating from it as changes in capacity and demand tend to be slow-moving by

comparison with other energy markets.

One might lean on these justifications for assuming higher prices in the future. But without a catalyst

for any of them the trend lower seems equally likely. In any event, such factors affect spot prices while

developers should be more concerned about longer-dated forward prices, which are the basis for PPAs

that guarantee the economics of development. The impact on forward prices doesn’t necessarily come

from expectations around physical supply and demand. Rather, it tends to come from the activity of

hedgers buying and selling such long-dated contracts. This activity has already pushed long-term power

prices down. The issue today is whether it will continue to do so.

So are renewables at a similar stage to E&P companies before the commodity price decline?

We don’t know. And anyone arguing otherwise bears the onus of proof, or at least a credible forecast

model which we have yet to see. More importantly, capital markets need to acknowledge that

renewable developers have increasing exposure to energy prices, and this makes them more akin to

their oil and gas brethren than they had been in the past.

We mentioned earlier that energy investors tend to stay in their lane. So it’s quite possible that utility

and IPP investors today aren’t really aware of the role that commodity prices play in their portfolios.

Instead, they may be more focused on the role that interest rates can have on investments. Since

utilities are largely yield-bearing companies, declines in interest rates tended to benefit utilities because

it raised their relative return vs. fixed income. The recent move higher in interest rates should now

make utility yields less attractive on a relative basis. Indeed, during most of the equity market’s rally –

and interest rate rebound – over the past year utilities have trailed behind.

In today’s investment climate, utilities are not richly valued, but those with substantial renewable

portfolios are. The latter have a growth story, which is good, until the aggregate market fundamentals

no longer warrant it.